On November 12, 2021, the Toncoin cryptocurrency began trading on the OKEx. In addition to trading on this exchange, TONCOIN can also be placed in long or short positions on perpetual swaps.

In this guide, we will show you how to trade Toncoin on swaps step by step on your phone.

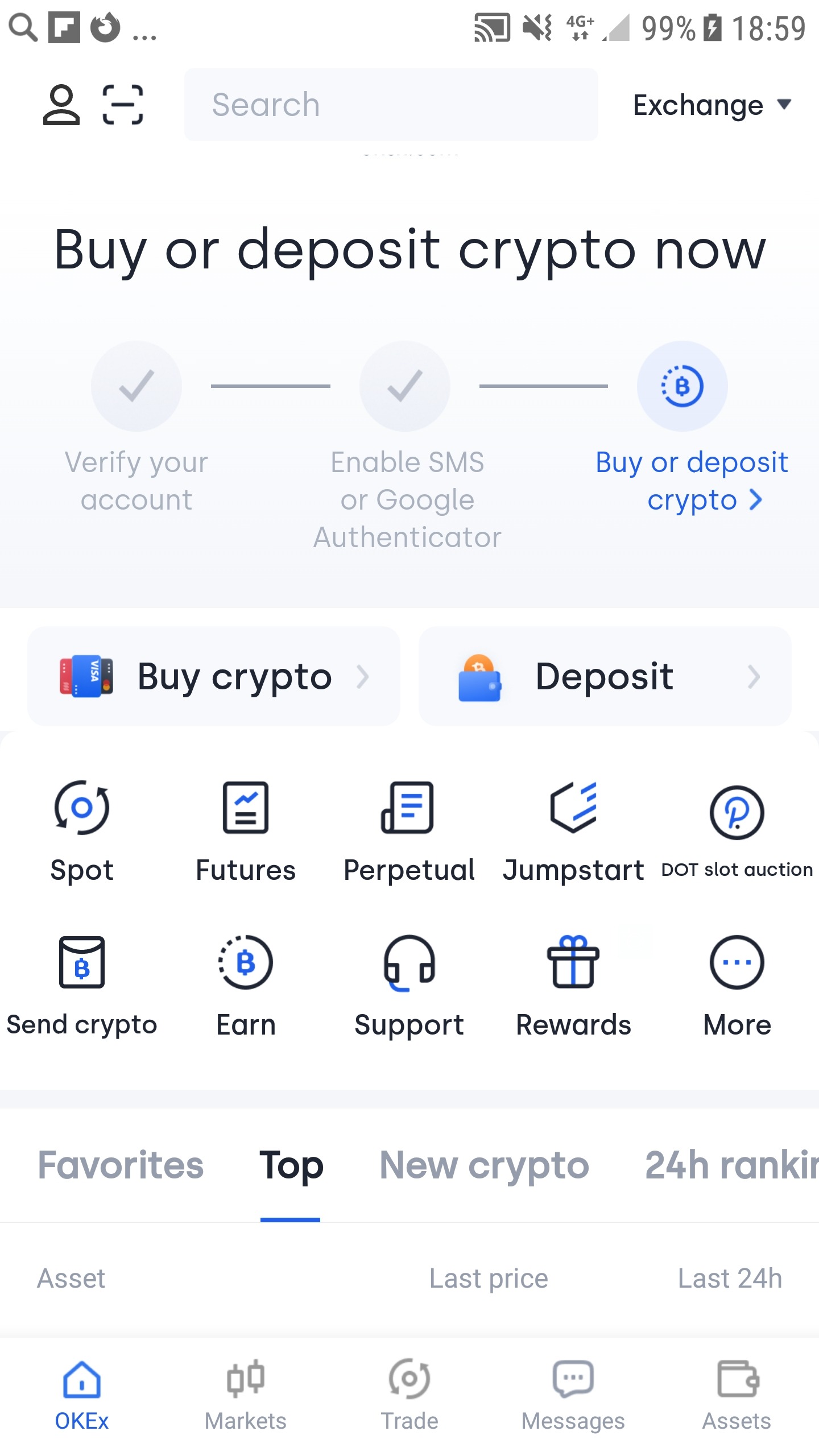

Go to the official website of the market: www.okex.com.

To register, enter your email address and password. To complete the account creation, use the confirmation code received at the specified e-mail when logging in to the account.

Next, go through identity verification (KYC) in the Identity verification section (click on the icon with a little man in the upper corner): enter your personal information (Level 1), verify your account by photo (Level 2).

To navigate further instructions and screenshots, download the OKEx mobile application – the Download application button is available in the site menu or in a pop-up notification on the pages www.okex.com.

In the Trade section in the settings menu, select Account – Settings, Account Mode – Single Currency Margin:

In the OKEx section, you need to switch to Professional mode – for this, click on the little man icon in the upper corner:

There are three ways you can fund your USDT balance on the exchange:

1) Make a deposit to the cryptocurrency balance

2) Buy from a bank card using the “express purchase” function

3) Buy from a bank card using the p2p trading function

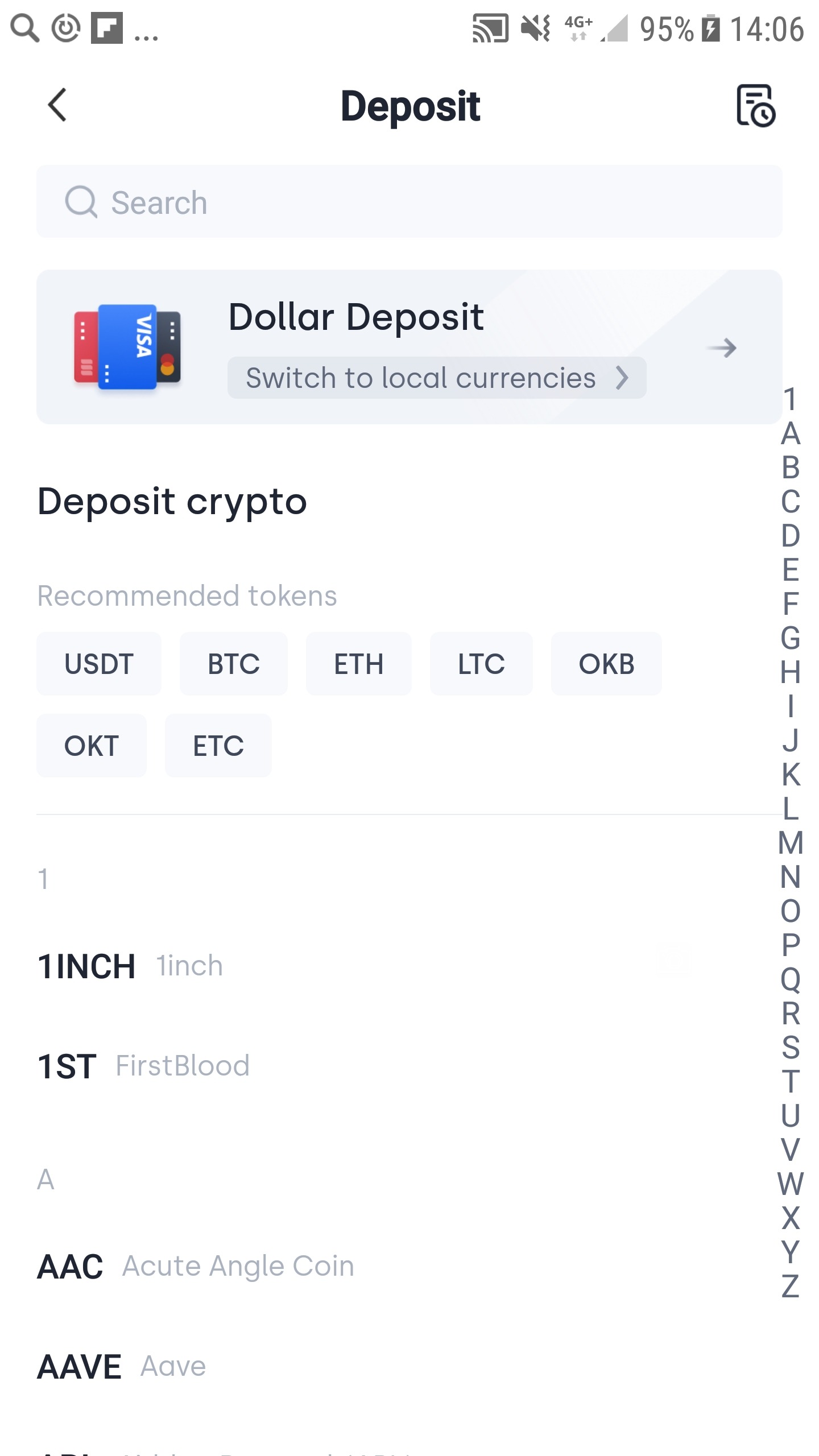

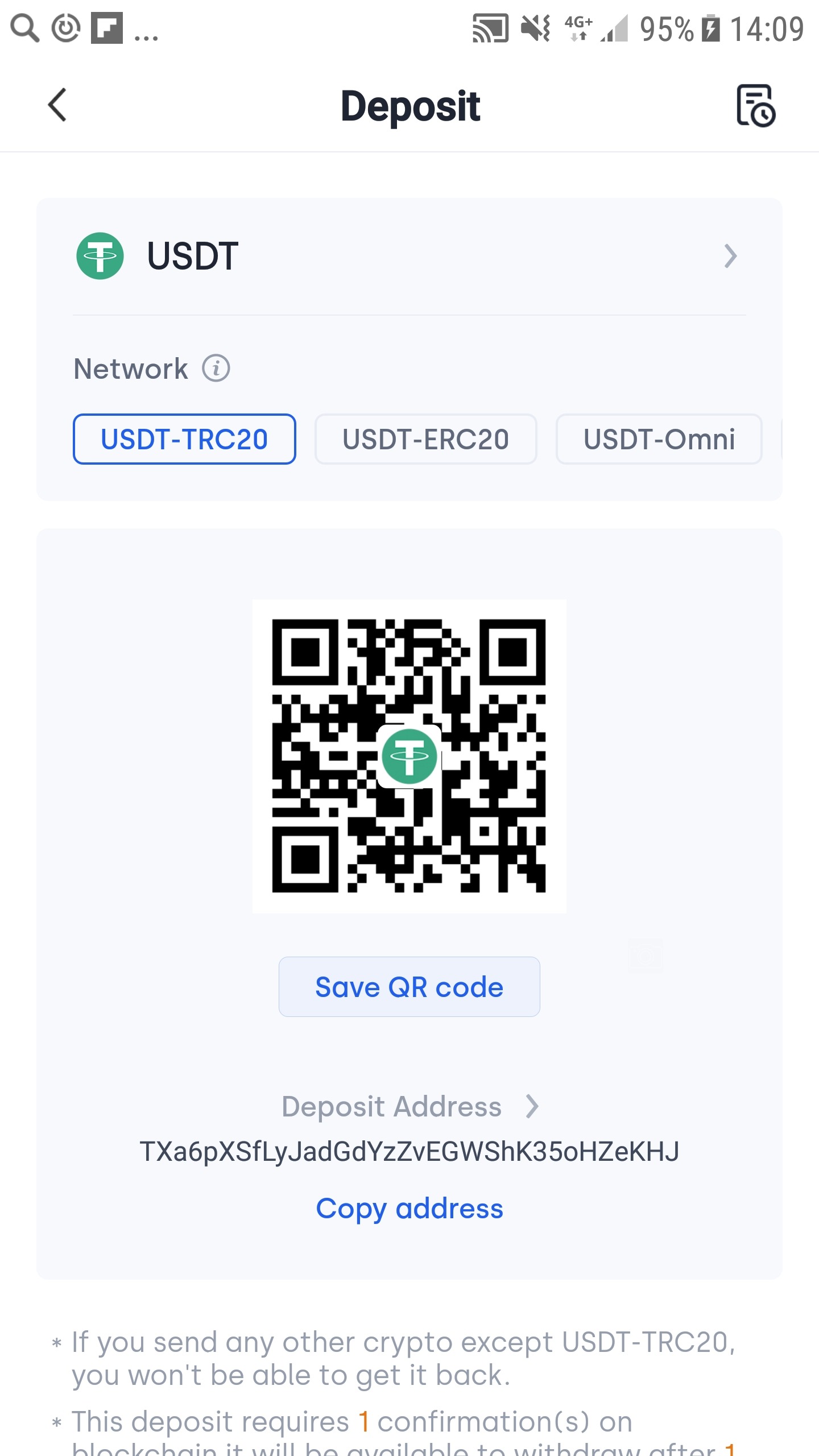

The OKEx exchange for each client automatically creates cryptocurrency wallets for all cryptocurrencies presented on the exchange. We need a USDT wallet address. We can find it as follows – click on the Assets section, then go to the Deposit and select USDT:

You can transfer USDT to this address from other wallets or exchanges.

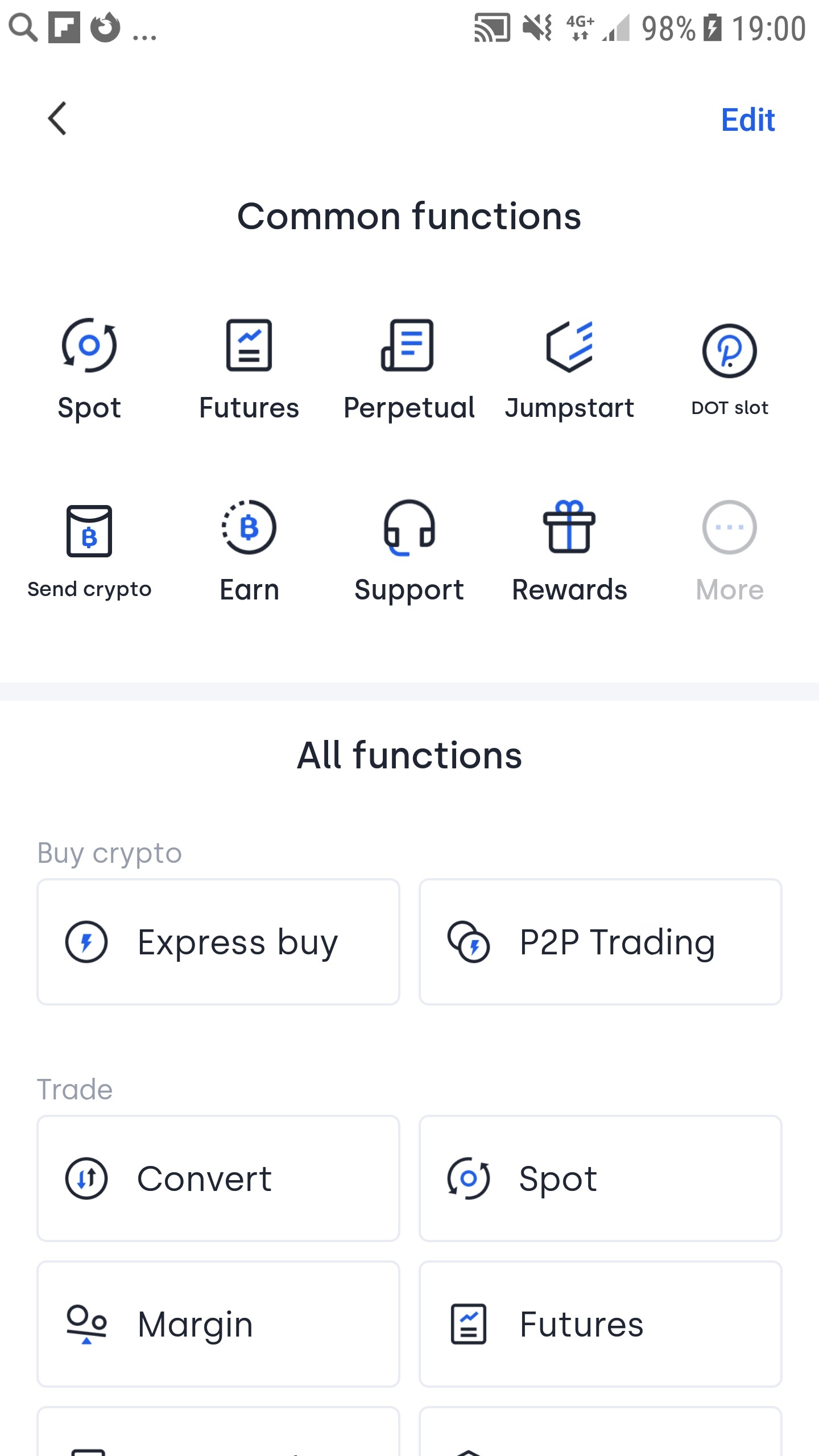

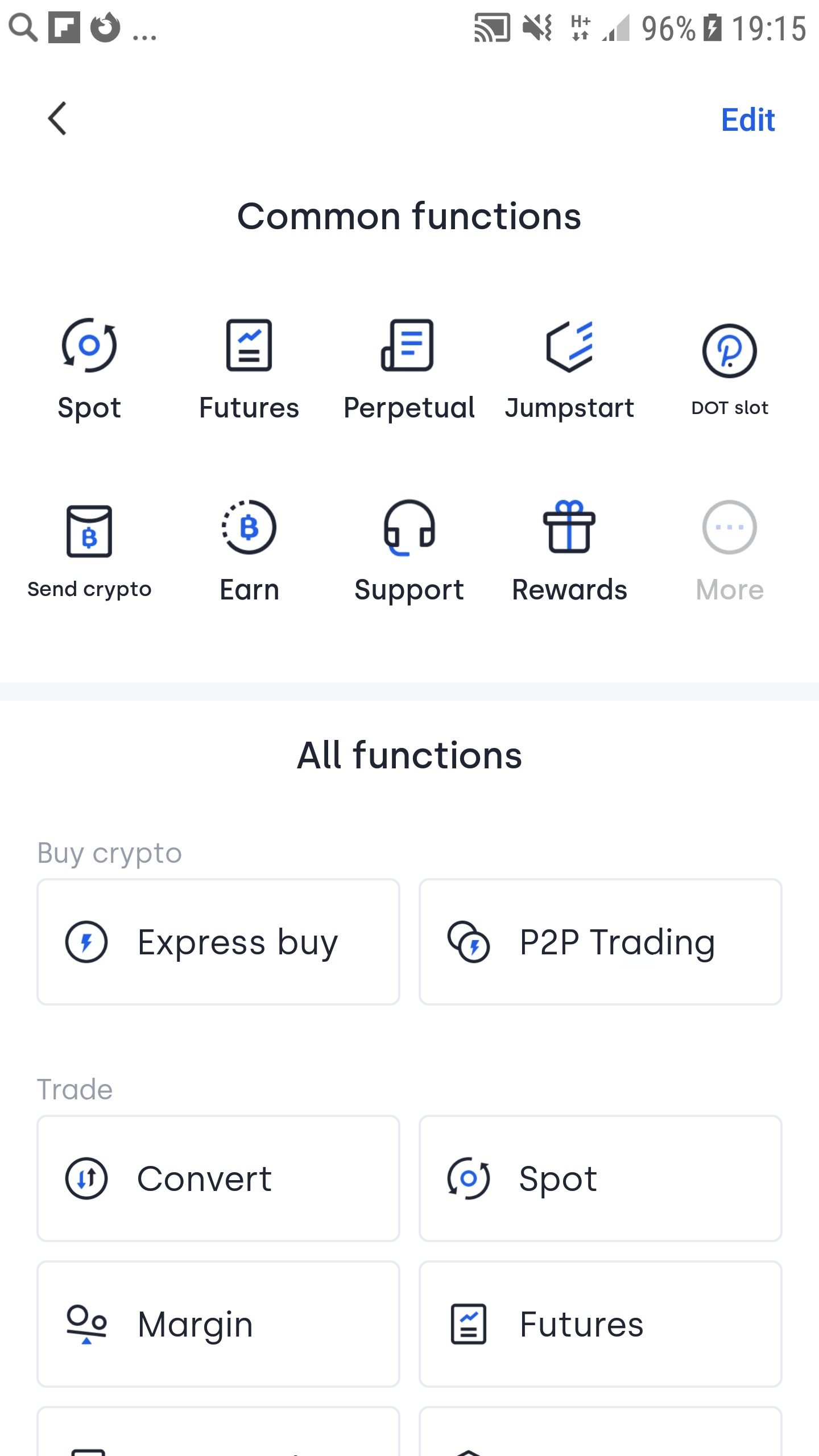

Go to the OKEx section, click “More”:

And then select “Express buy”:

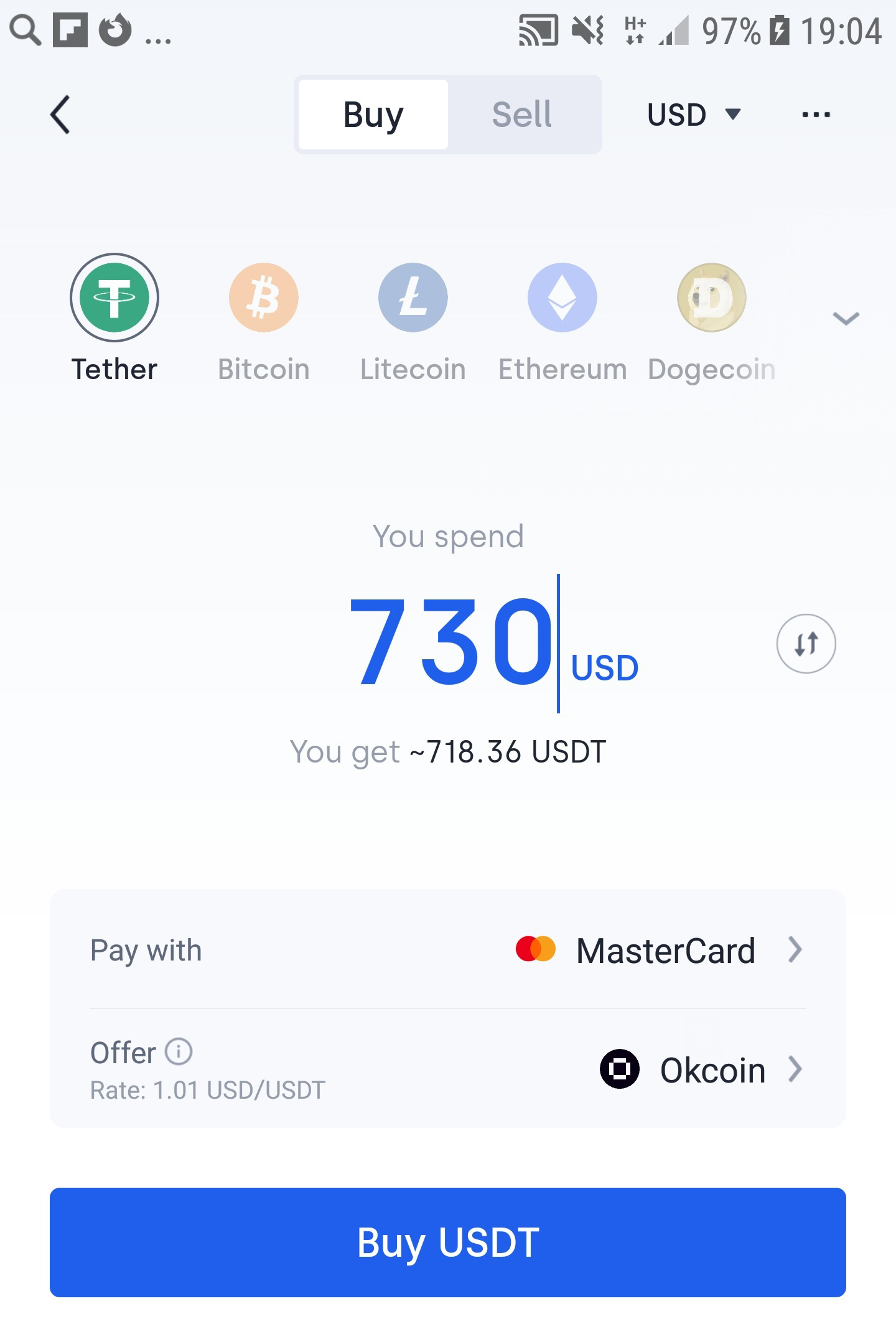

Choose Tether (USDT). Indicate how much you want to buy, select the payment method and payment gateway, and then click Buy USDT:

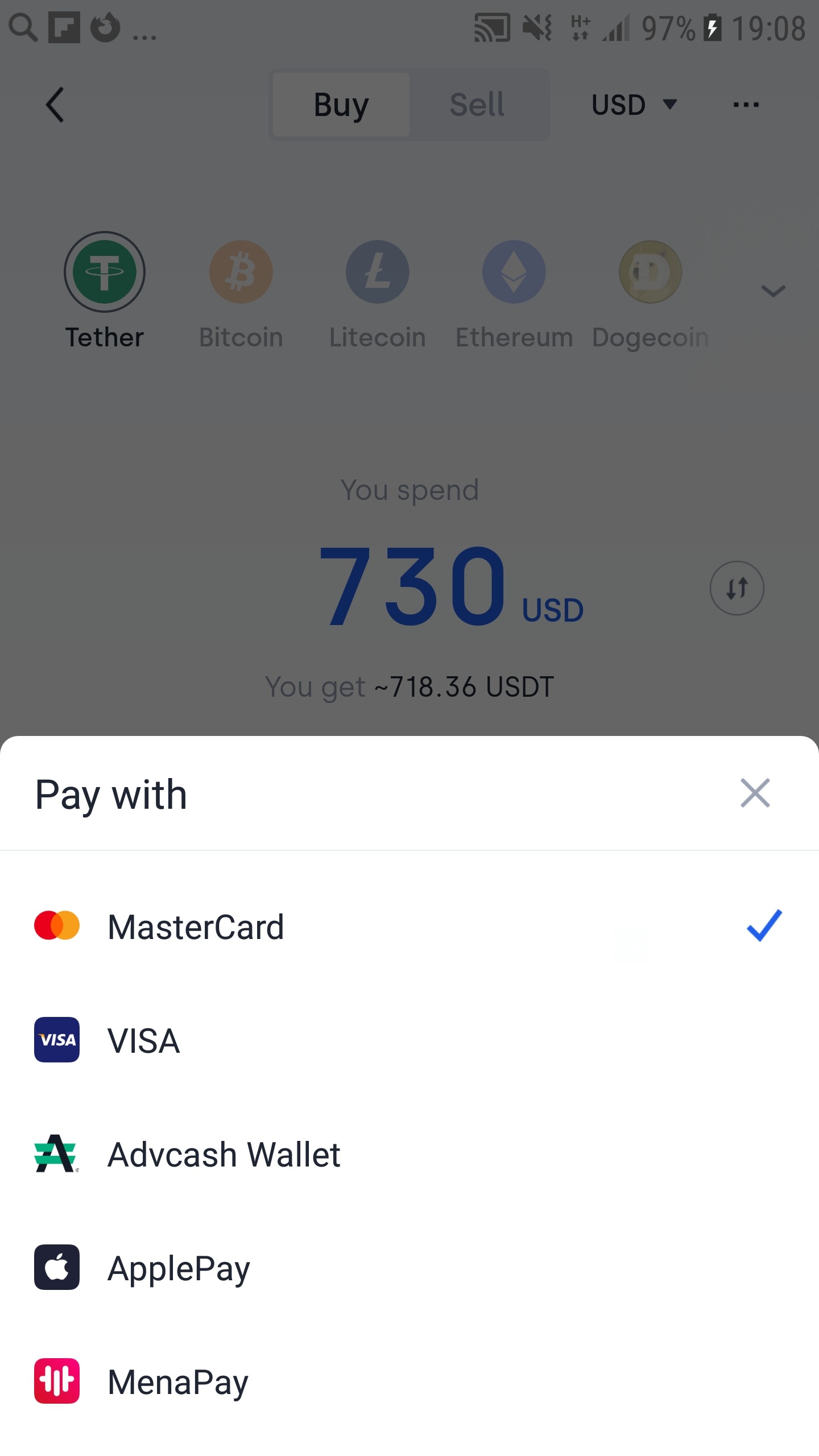

Payment Methods:

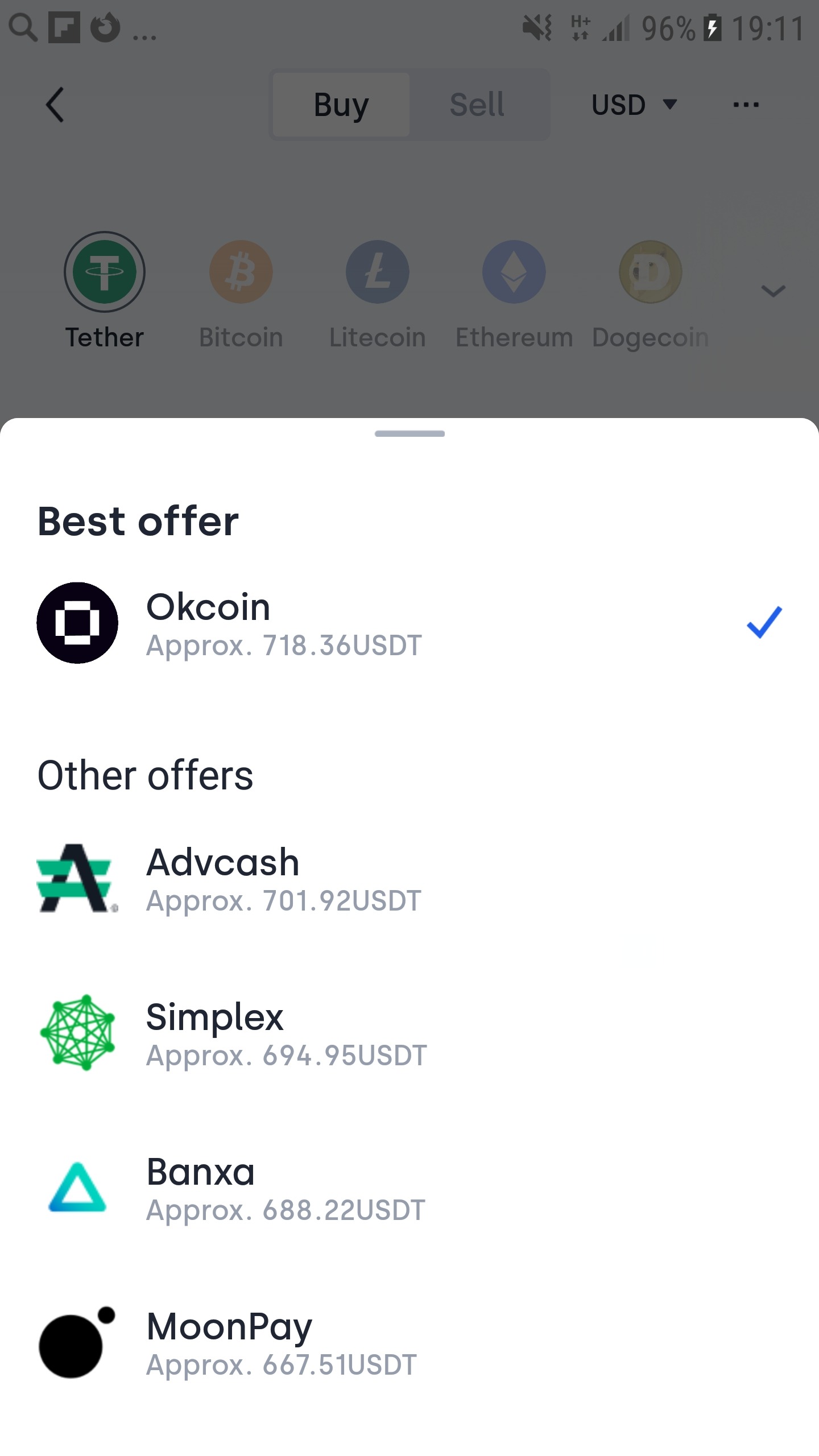

Payment gateways are payment systems that support the sale of cryptocurrencies, each with its own commission. The best offer means that this gateway has the least commission:

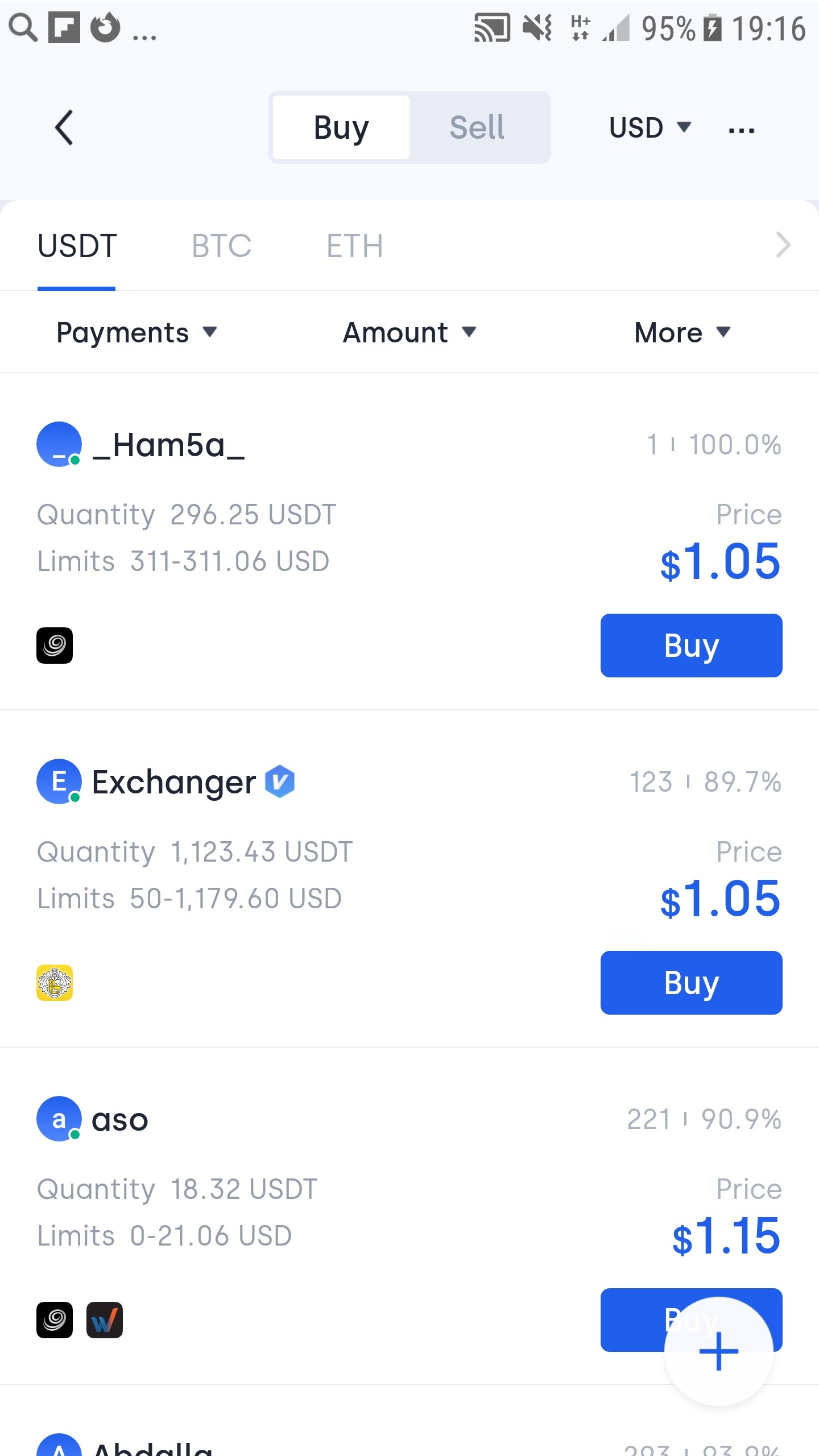

P2P trading is the direct purchase and sale of cryptocurrency by users without the involvement of a third party or intermediary. Unlike the second method, where we bought currency from gateways, here we buy cryptocurrency from other people, in this method there is less commission and there are practically no purchase limits.

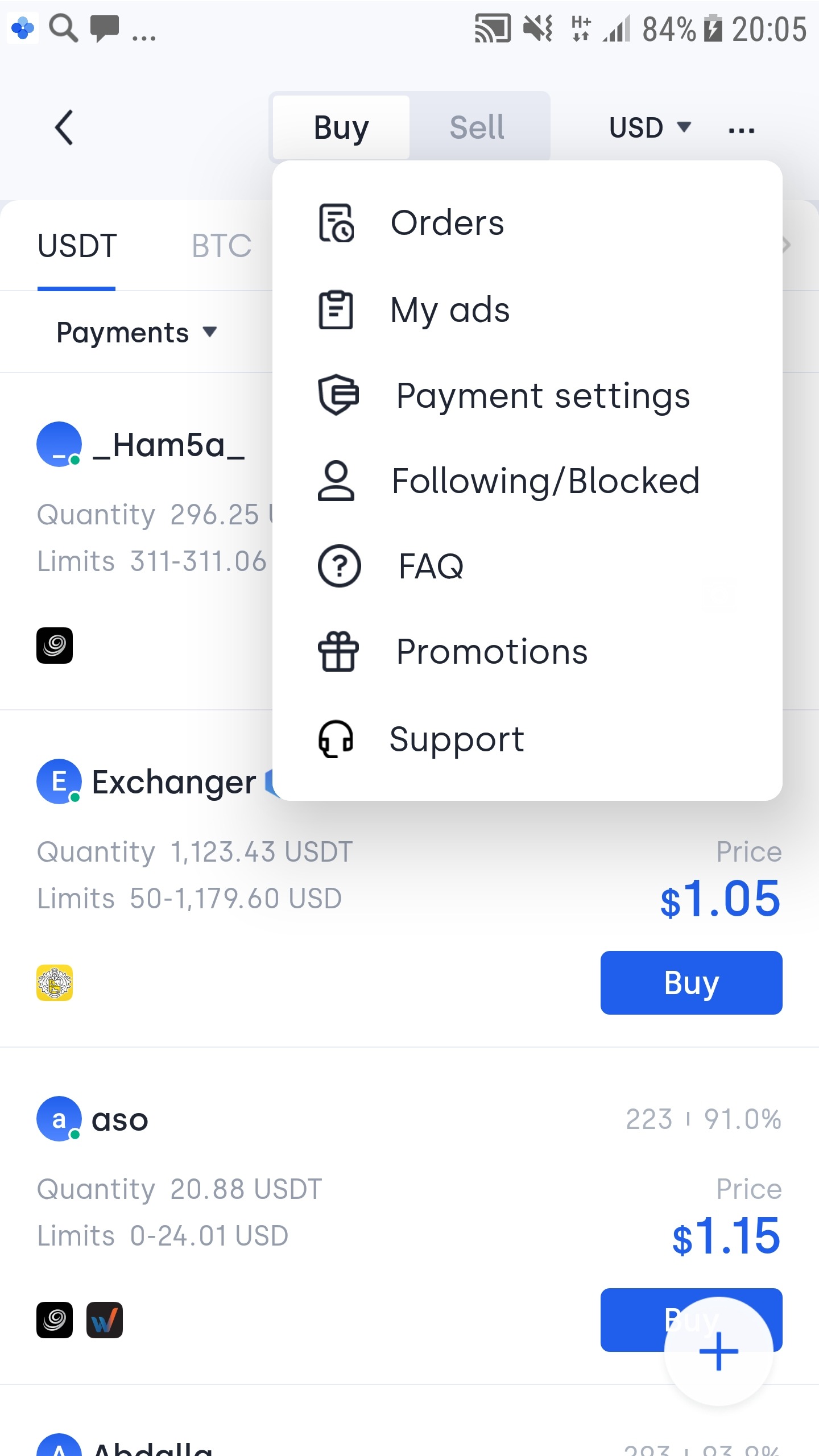

Go to the OKEx section, click “More”, and then select “P2P trading”:

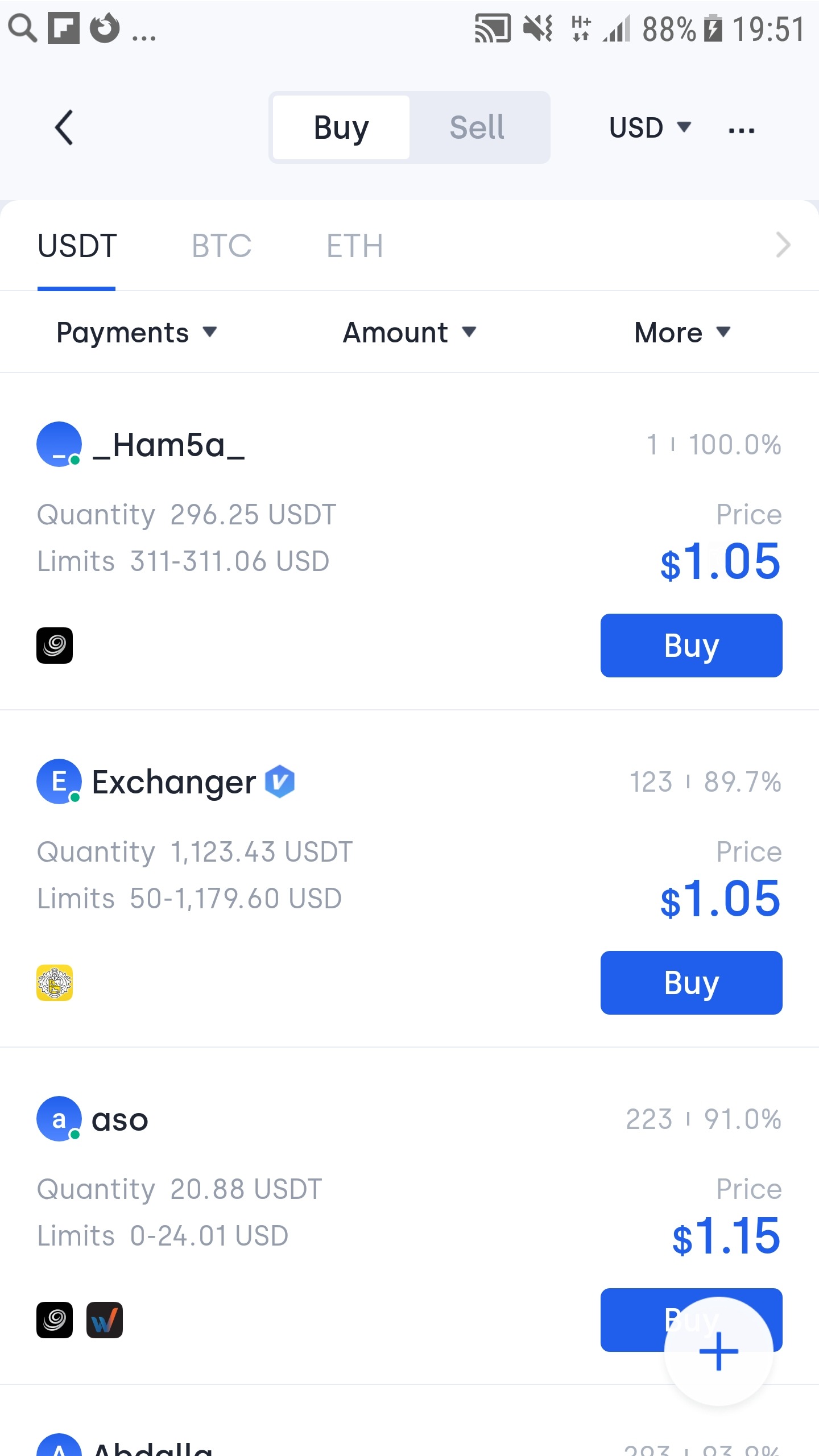

We are on a P2P exchange:

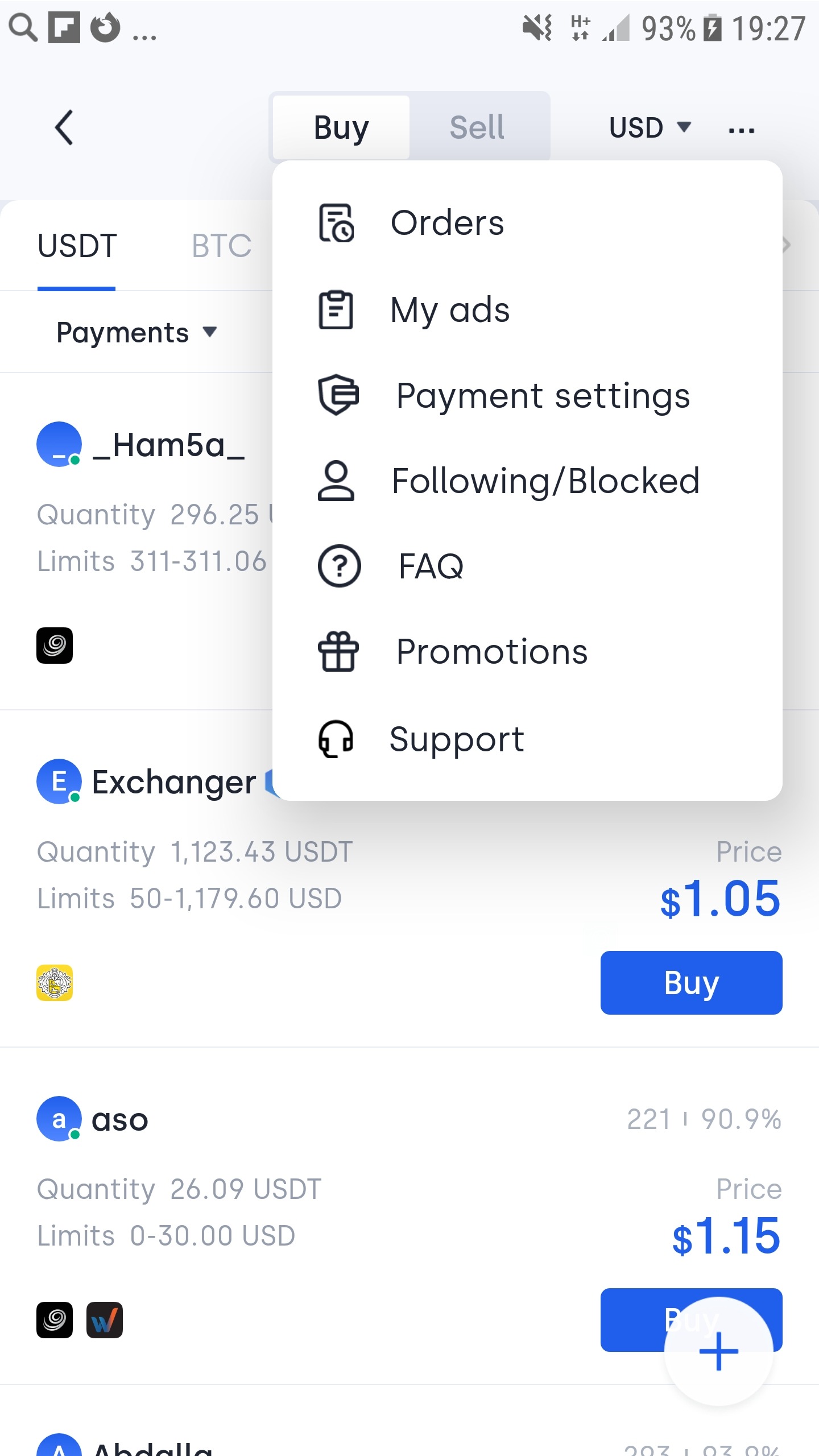

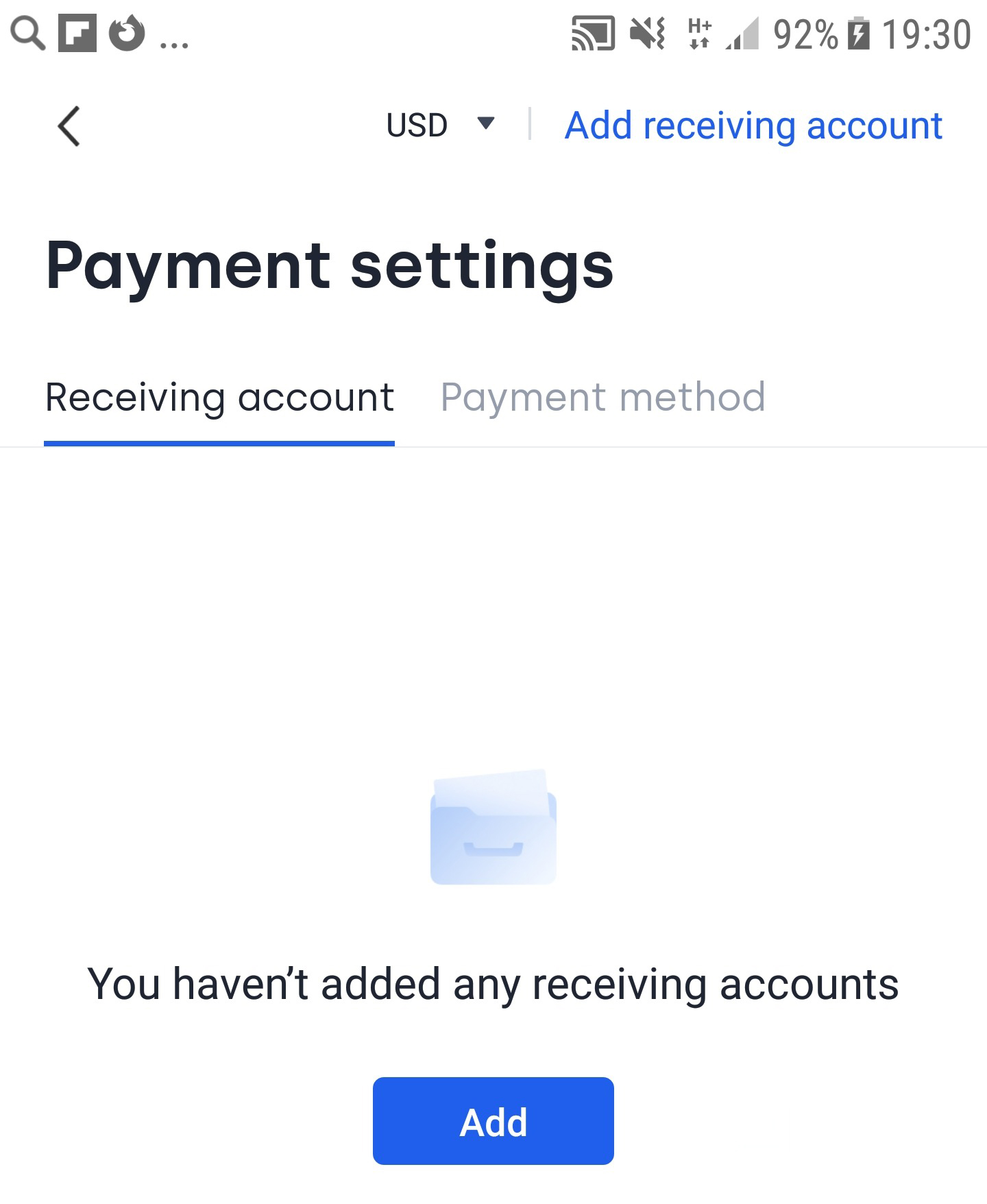

But before performing any manipulations, you need to add payment settings:

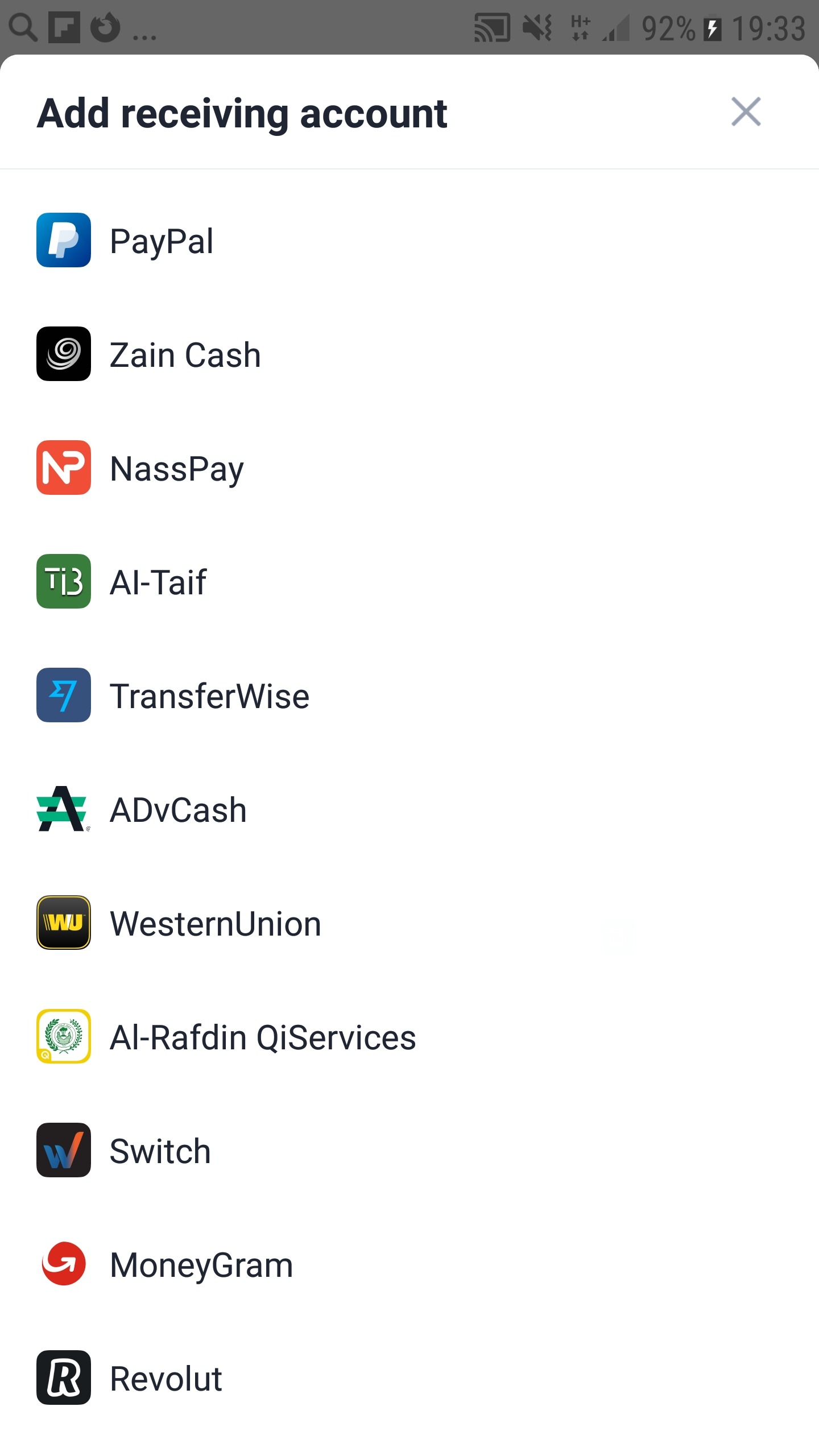

Select the necessary payment methods and add an account to receive funds:

Select a bank to the account in which we will receive funds from the sold cryptocurrency:

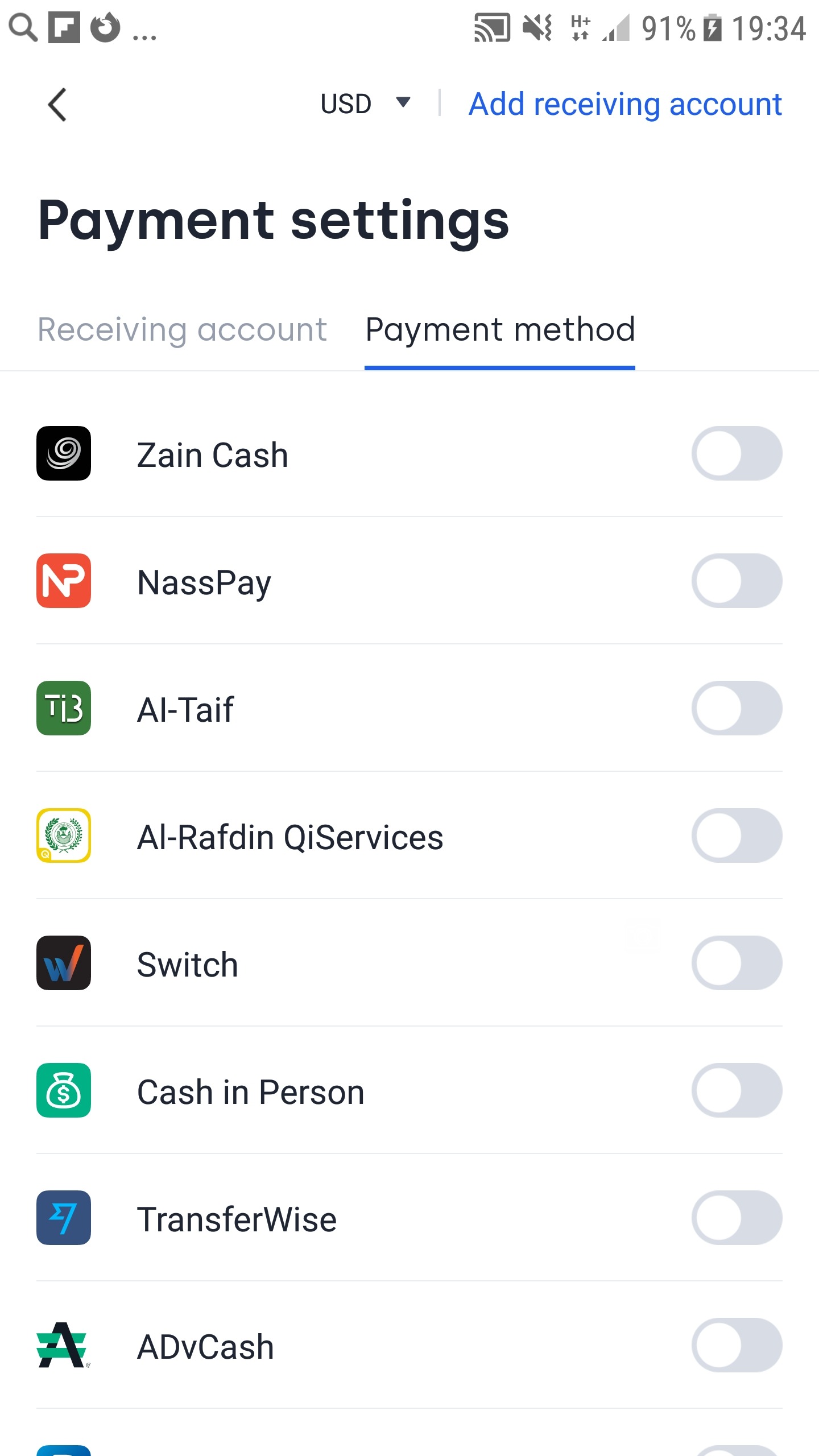

Include all applicable payment methods:

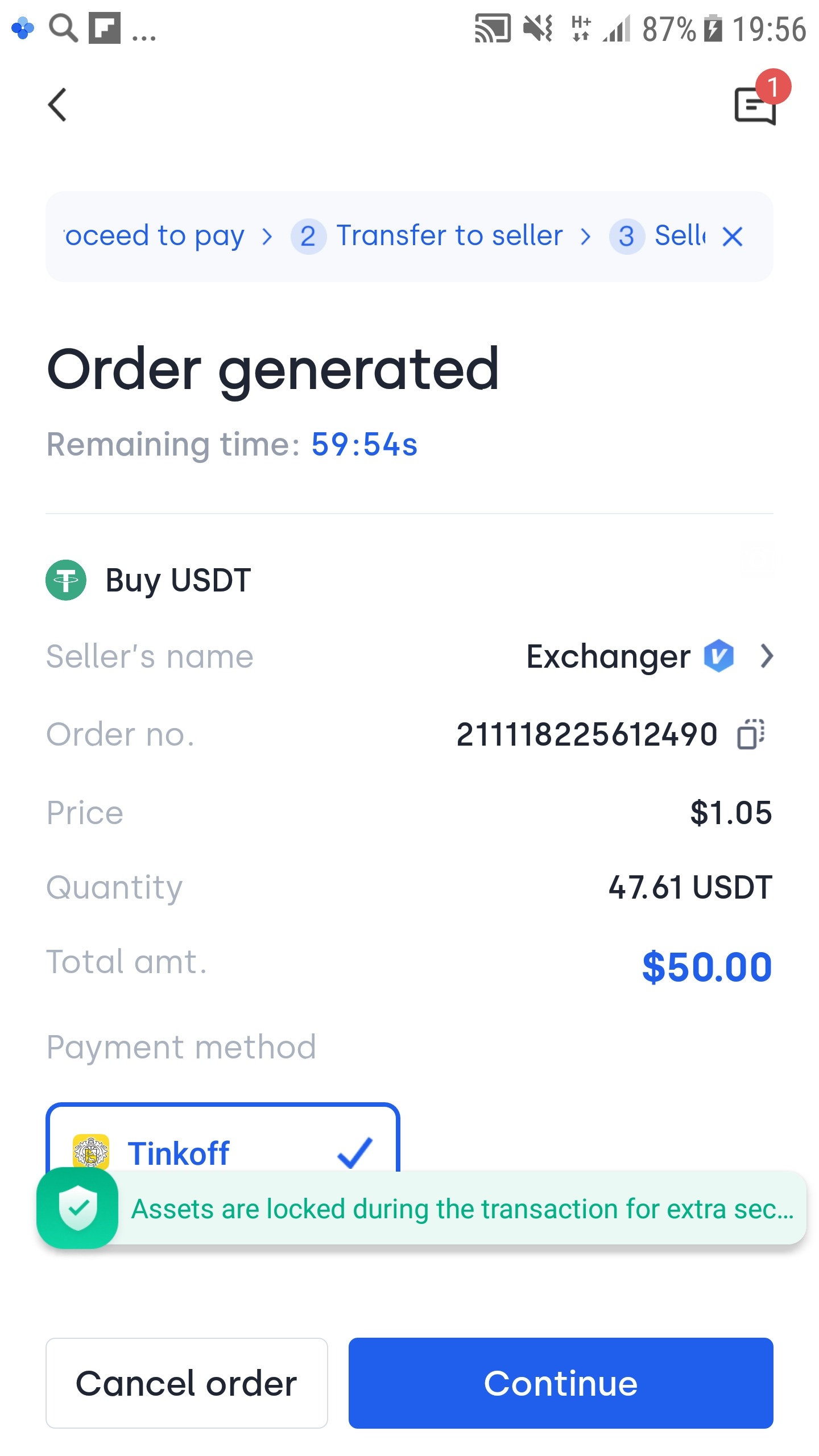

Then we go back to the list of offers, select the one that is suitable in terms of volume and price and click “Buy”:

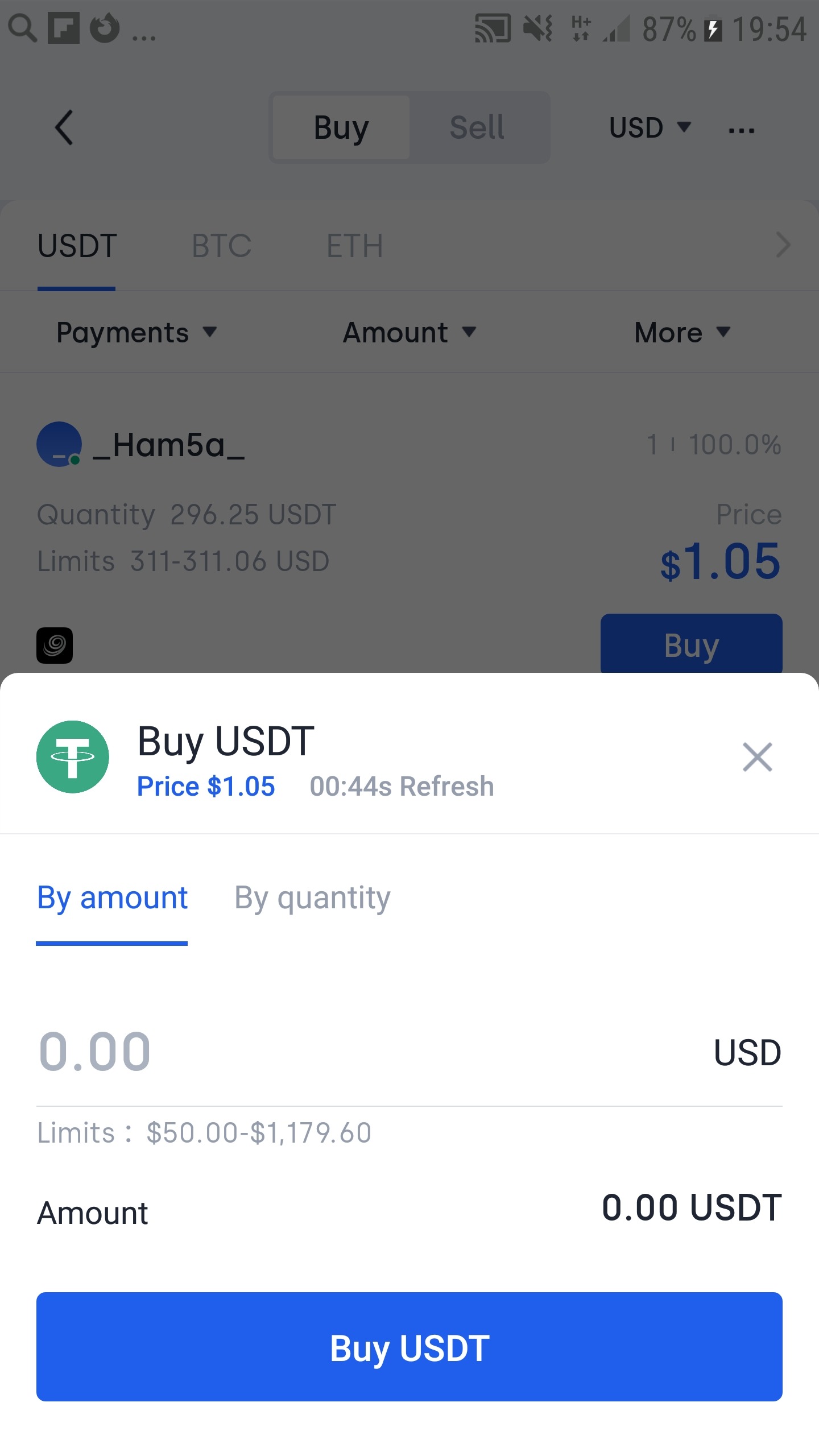

Enter the purchase amount:

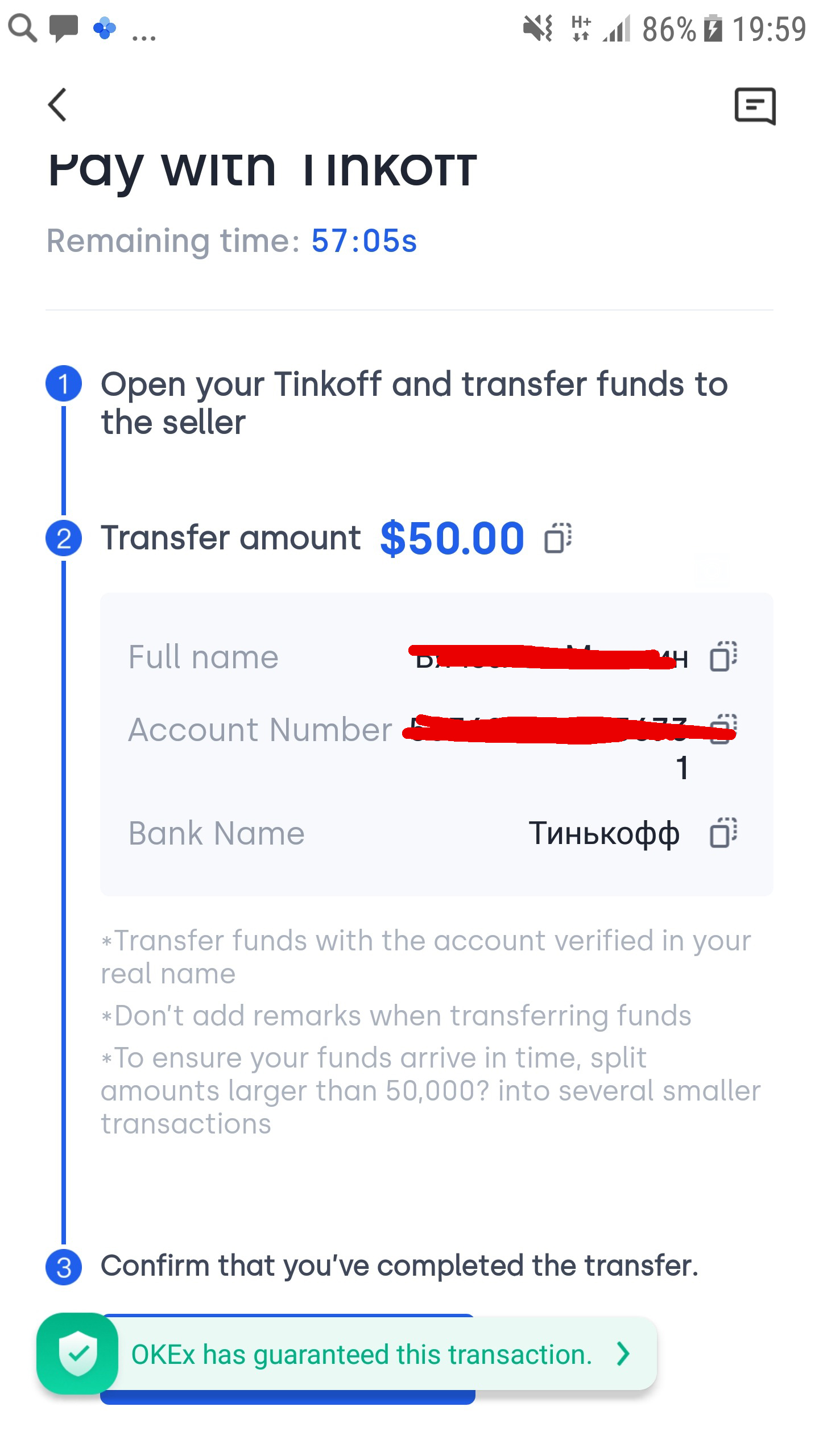

Choose a payment method and transfer funds to the seller:

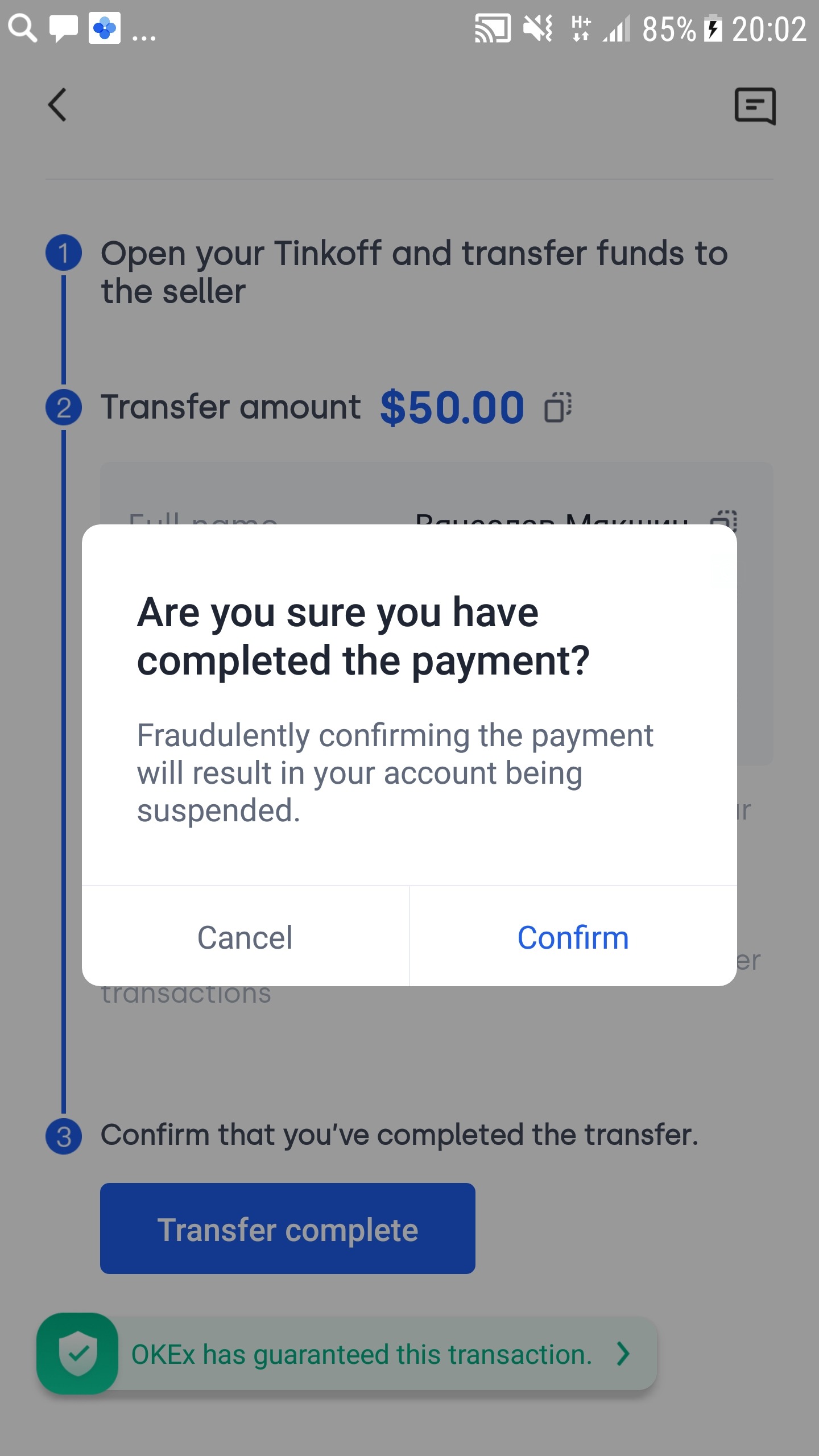

Confirm payment:

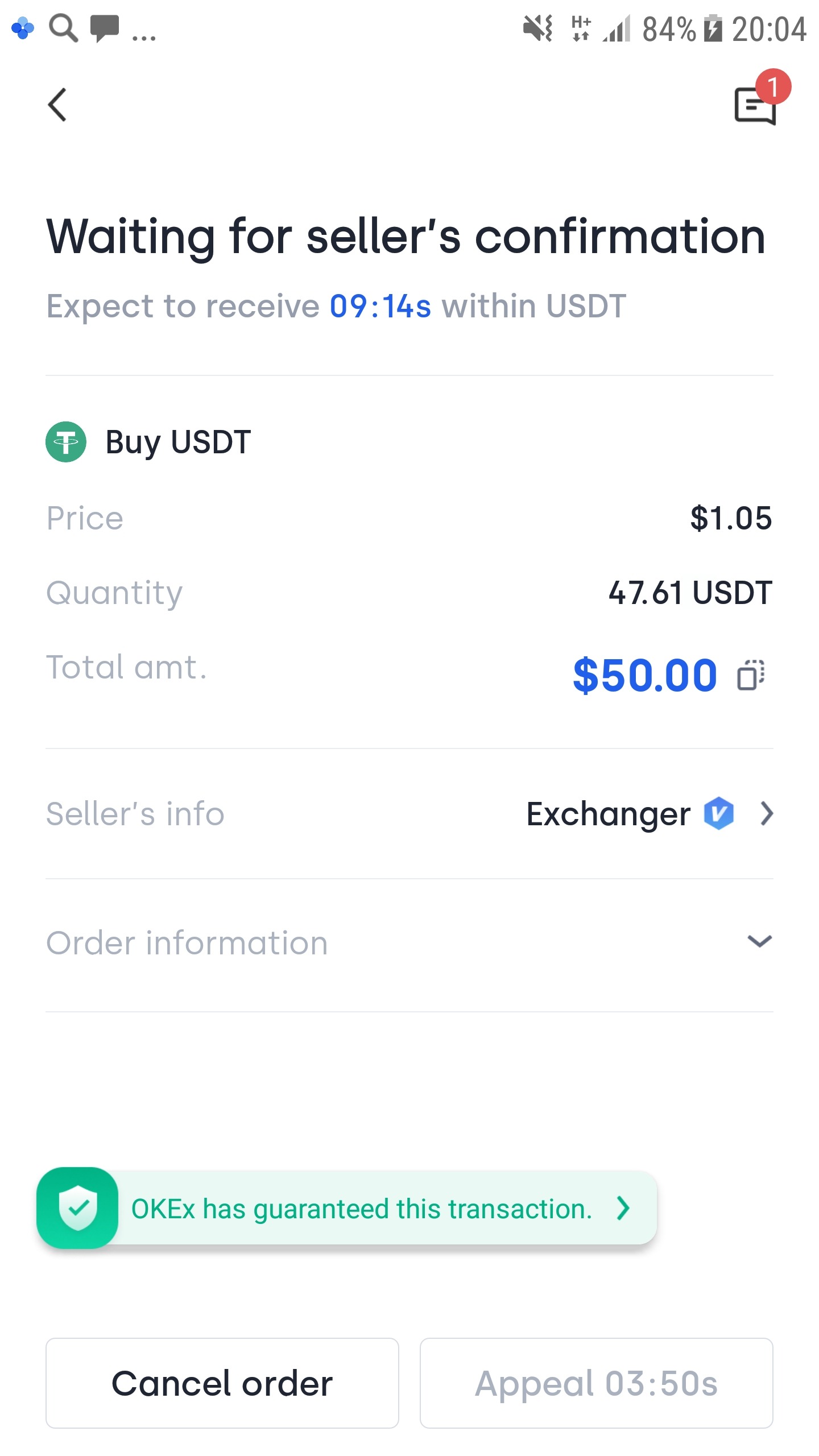

To check the status of a transaction, go to the P2P orders tab (the “Order” button). As soon as the seller sends you the cryptocurrency, the order will automatically change its status to “Completed”:

Before starting to trade, let’s define the basic terms for trading perpetual swaps.

Futures – Futures is a contract that guarantees that a buyer buys an asset at a specified time, in a specified amount, at a predetermined price. Futures has built-in leverage, which allows you to trade more than the actual amount in your account.

Perpetual Swaps are futures contracts with no expiration date. Like futures, swap allows you to use leverage when making trades. The contracts are entered into without requiring ownership of the underlying asset that the swap represents. In other words: you do not need to have Bitcoin in order to open a swap on it.

Long (“long position”, long) – buying an asset in order to earn money on its growth.

Short (“short position”, short) – the sale of a security in order to make money on its fall.

Leverage is the ratio of a trader’s money to the total amount of funds he is trading. The exchange provides funds several times higher than your own. How many times depends on the selected leverage (2x – twice, 3x – three times, etc.). Using leverage allows you to get more income than if the trader used only his own funds. But the losses, respectively, will also be greater.

Margin is the collateral that the investor must provide to the exchange in order to open a position. For example, if a trader plans to open a 10:1 margin trade on $10,000, he needs to invest $1,000 as collateral.

The margin is cross and isolated. In the first case, all trading pairs will depend on one margin account, and in the second, each trading pair will have an independent margin account.

The liquidation depends on the price of the marking (asset price), the size of the credit leverage and the amount of margin.The liquidation depends on the price of the marking (asset price), the size of the credit leverage and the amount of margin. When the portfolio goes into negative territory, which can no longer be covered by the margin, there is a margin call.

Margin Call – This is the state of a liquid portfolio when its value falls below the minimum margin. This may be nothing more than a warning and a strictly formulated proposal to close some or all of the trades or deposit additional money to meet the minimum margin requirements.

If you do not do this and the level of account funds drops to 10%, a stop-out will happen. At this stage, your trades will be automatically closed by the broker, starting with the most unprofitable ones. Complete closure of all transactions on the account is also possible.

A liquidation occurs when the price of the label reaches the liquidation price of the position. To avoid liquidating a position, traders are advised to pay close attention to the movement of the label price and the liquidation price.

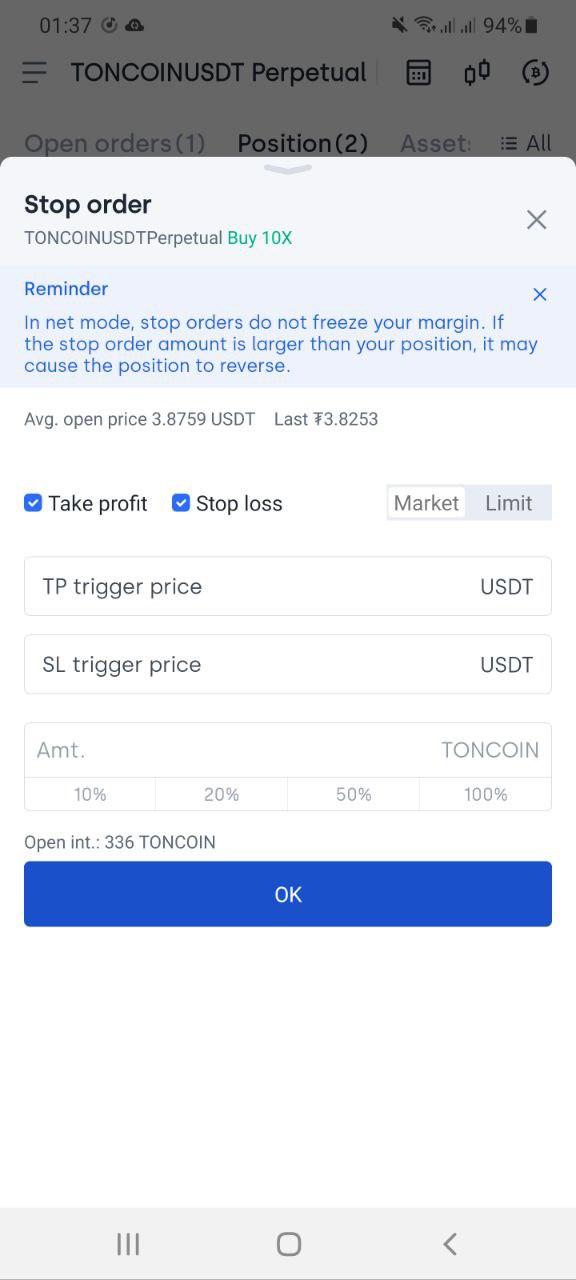

Stop Loss and Take Profit are types of protective orders that are placed to automatically close a trade. Stop loss limits the trader’s possible losses, take profit helps to fix the profit when it reaches the desired level.

Profit and loss statement or PNL – a report showing the investor’s profit and loss for a certain period. PNL can be realized and unrealized.

The realized PNL shows the profit and loss for a closed position.

Unrealized PNL is a floating profit / loss ratio for an open position.

Let’s see how we can calculate PNL on swaps using Toncoin as an example.

Let’s say we have $100 and we want to buy TONCOIN with x10 leverage. Leverage x10 means that the amount of our assets increases 10 times and we buy not for $100, but for $1000.

At the time of this writing, the TON coin rate is $3,74 per piece. This means we are buying 267 pieces.

We can determine PNL using the following formula:

Let’s say we put Toncoin long and after some time it went up by 20% and began to cost $4,49.

So our PNL will be: 267 * (4,49 – 3,74) = $200,25 – this figure is our net profit.

Now let’s imagine the same situation, the TON coin rate went up by 20%, but we put it short.

So our PNL will be: 267 * (3,74 – 4,49) = — $200,25 – this figure is our net loss.

PNL is an important indicator, thanks to which you can clearly determine your efficiency when working in the cryptocurrency market. At the same time, you can calculate your profit or loss both from one position and from a series of transactions over a long distance. Only a clear understanding of your results will allow you to effectively manage your own capital.

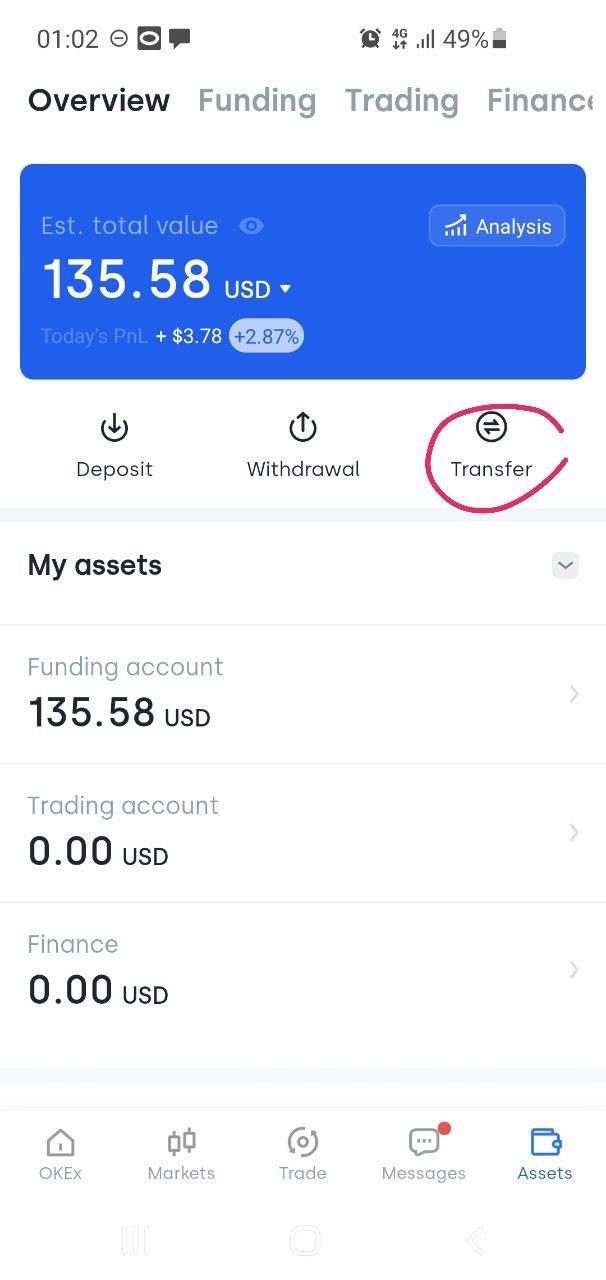

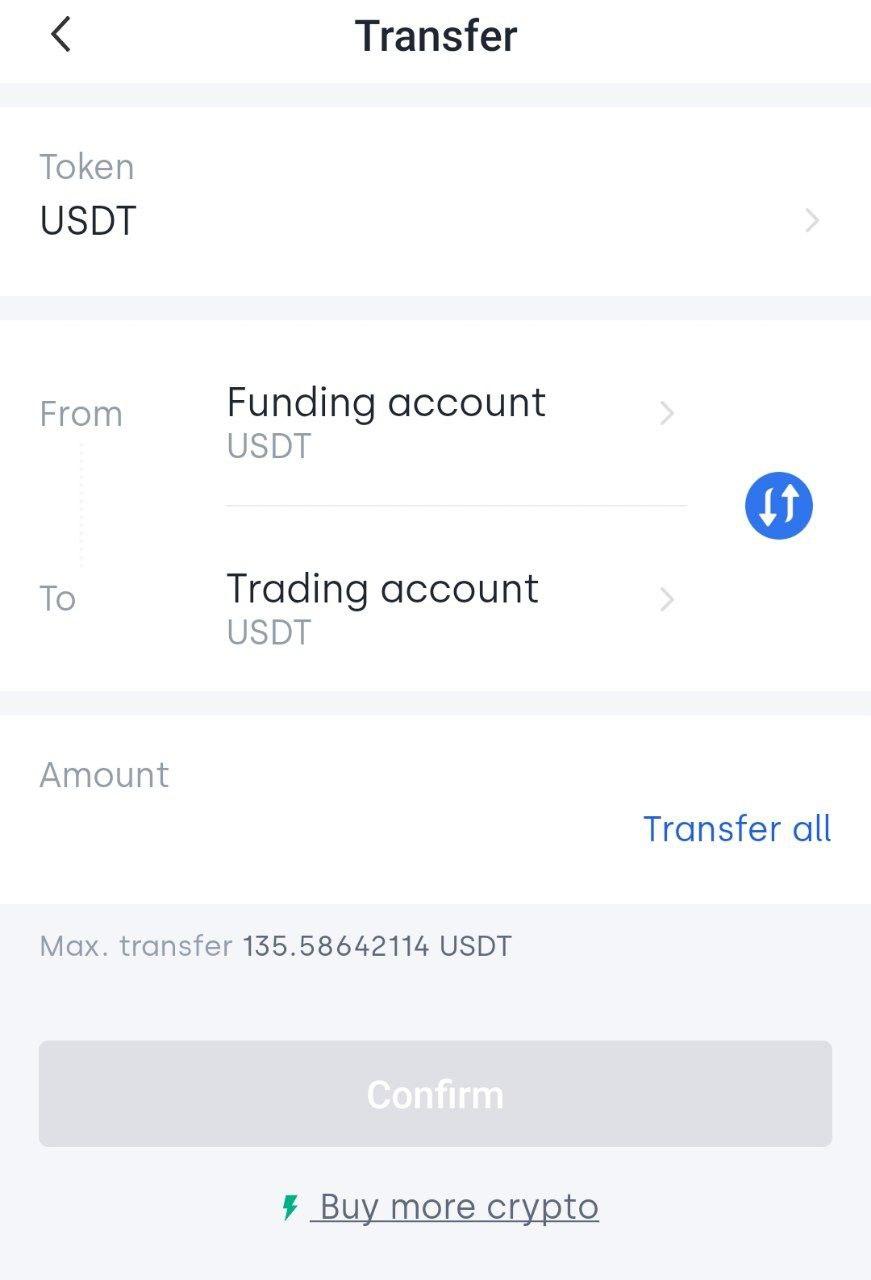

Now you can start trading. All previously purchased funds are now in the spot account. To start trading, they must be transferred to the Trading Account:

Select the amount you want to transfer and click Confirm.

Ready. Now you have the money in your trading account.

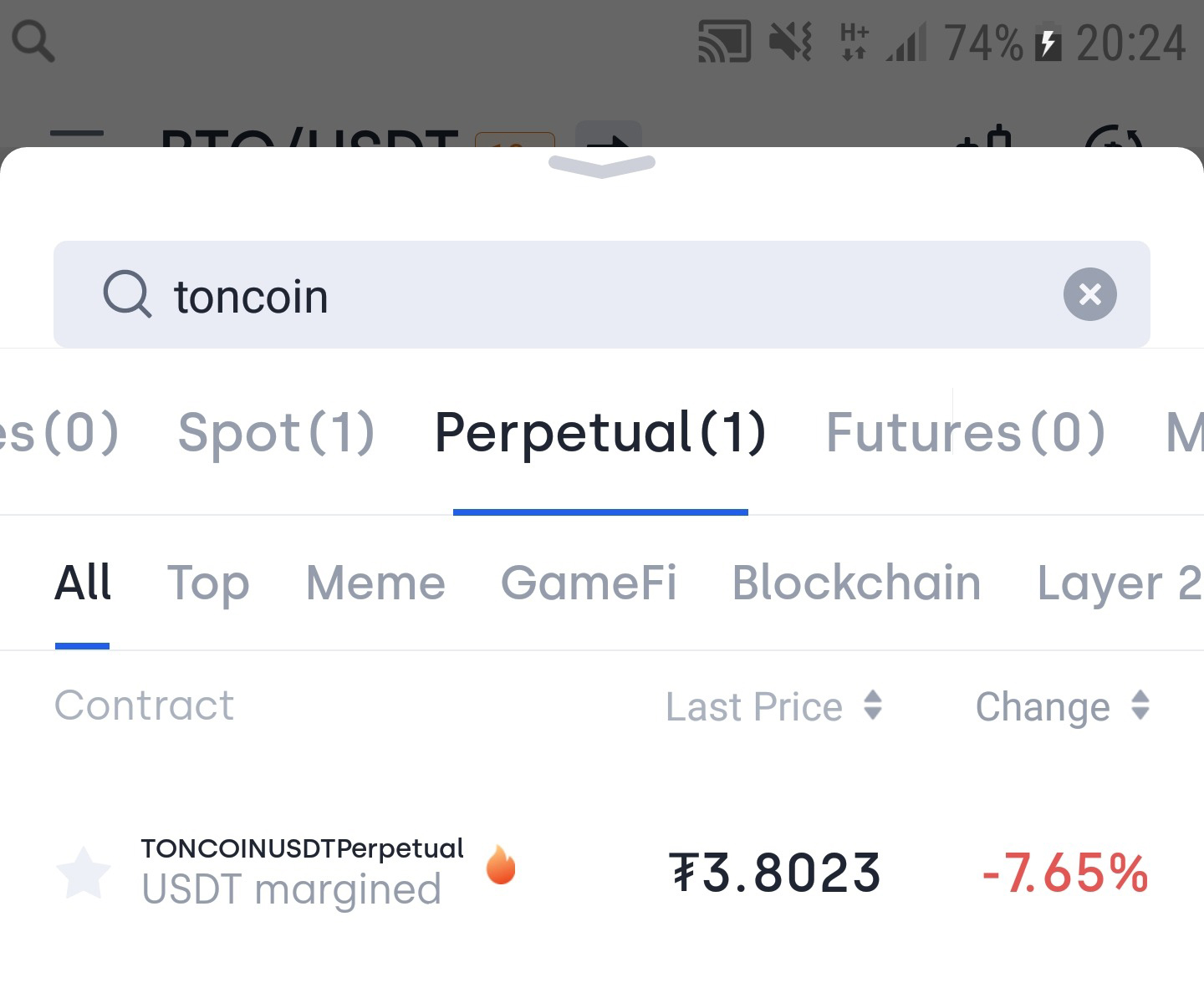

Next, go to the Trade section and find TONCOIN-USDT perpetual swaps in the margin trading section:

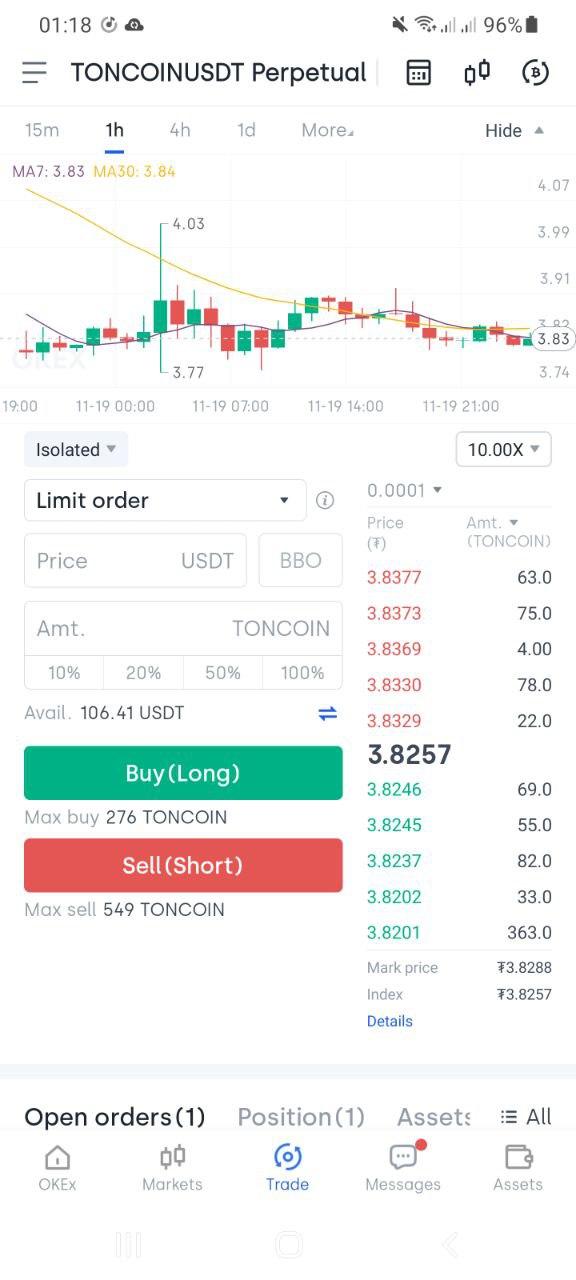

Next, select the price, margin, quantity and type of the order and place it depending on the need for long or short:

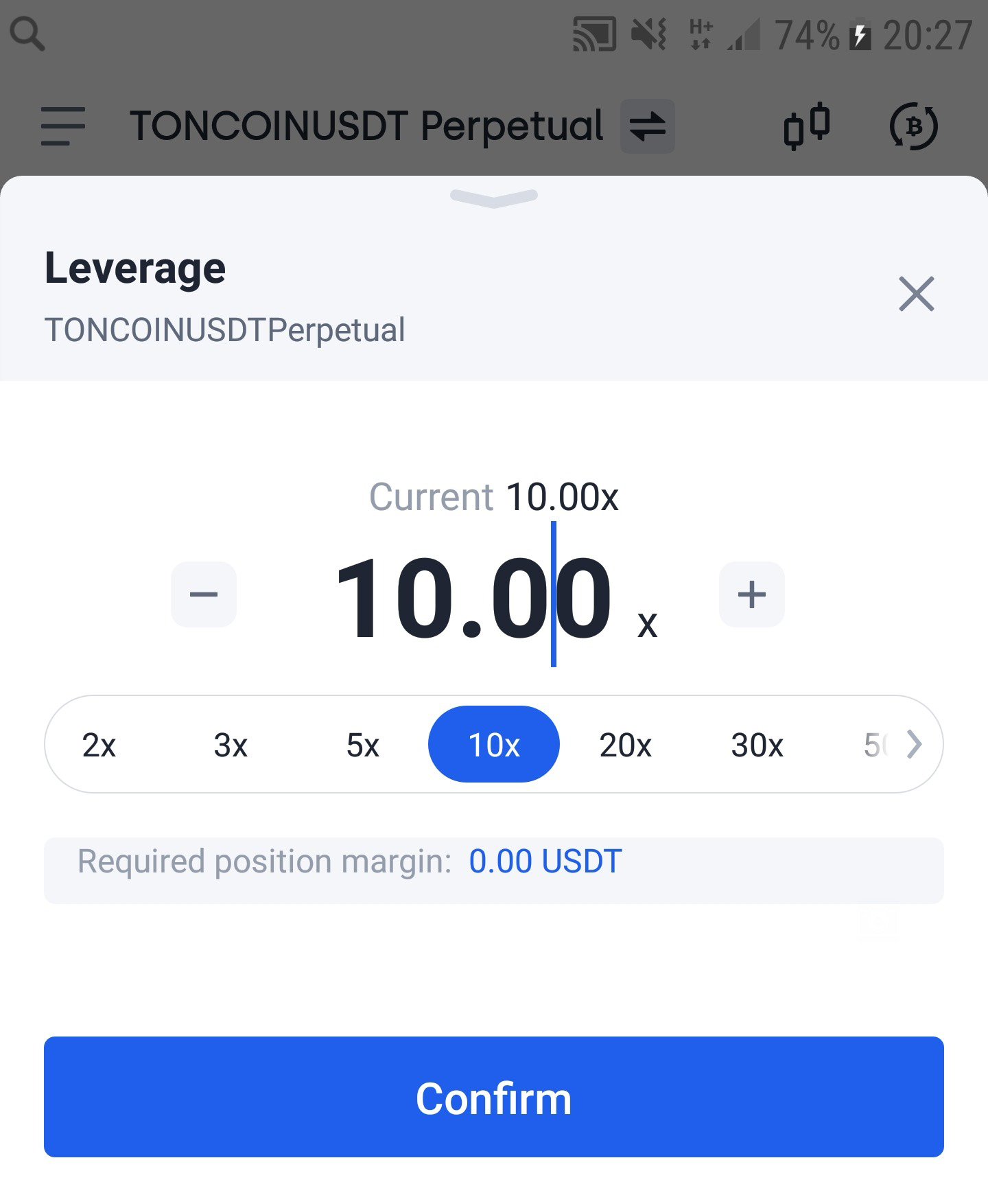

Let’s try to place a long limit order in an isolated margin with a leverage of x10. As for short positions, it’s the same here, just instead of the Long button, click on the Short button:

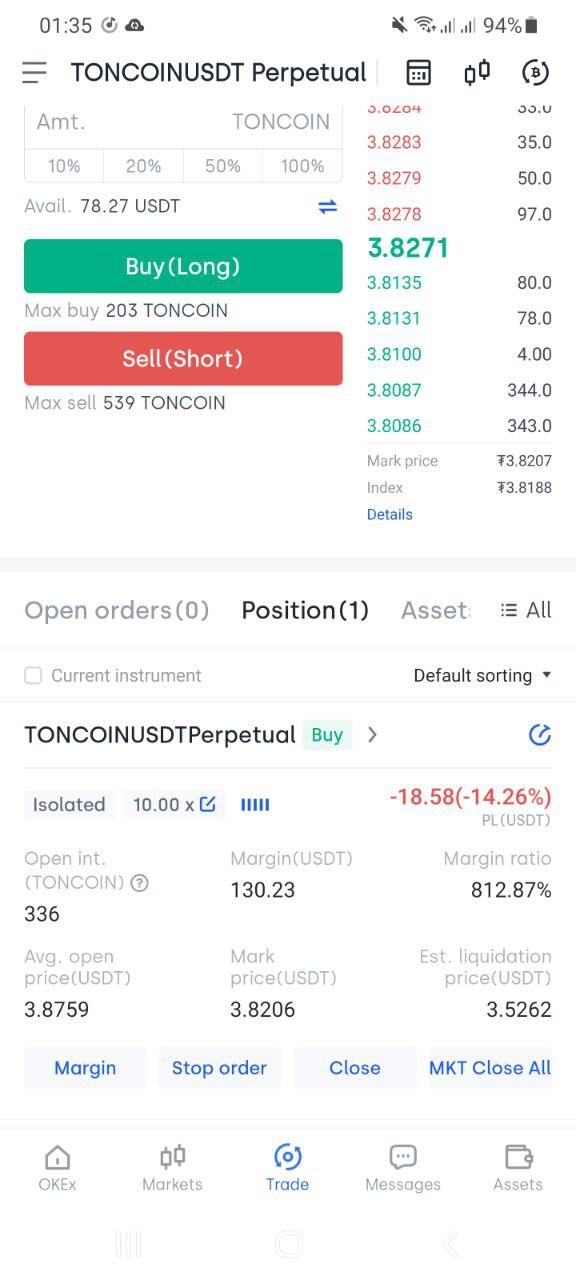

The order is ready. When the order price coincides with the price on the exchange, the tokens in the order are filled and transferred to Position:

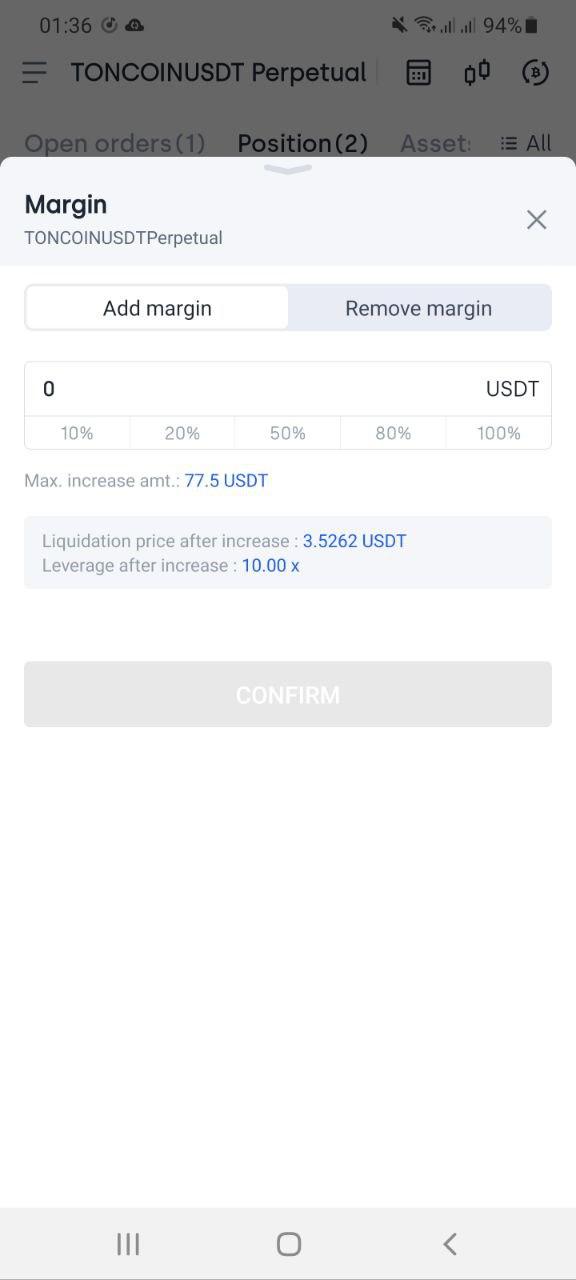

We can change the amount of margin by clicking on the “Margin” button.

You can place TP and SL orders by clicking on the “Stop Order” button.

Also, at any time, you can change the type of margin and the size of the leverage (the leverage can only be changed upwards).

When it is necessary to close one position, click on the “Close” button. When it is necessary to close all positions, click “Close All” accordingly.

If you haven’t bought your first Toncoins yet, you can do so on one of the official partner platforms: CryptoBot, Mercuryo, OKEx or EXMO. Then you can transfer them to a native wallet and use them (store, transfer). If you have any difficulties with trading Toncoin on perpetual swaps (short or long) or buying coins, do not hesitate to ask for help in the chat of channel Give me Gram!